Vancouver’s housing market is on the move. The city grew about 9.4% from 2017 to 2022 (from ~176K to 195K residents) (www.theurbanist.org) – the fastest in the Pacific Northwest – and Clark County is Washington’s fastest-growing county (2020–23) (oregoneconomicanalysis.com). Planners say Vancouver must accommodate roughly 38,000 more homes (a 44% increase) in the next 20 years (www.cityofvancouver.us). In short, demand is surging even as supply lags. In 2025 Vancouver’s median sale price is roughly $477K (www.redfin.com) (still far below Seattle’s ~$899K (www.redfin.com) or Clark County’s ~$542K (www.redfin.com)). That relative affordability (and Washington’s no-income-tax rules) is driving an influx, especially of moderately high‐income Portland-area families. Census-based analyses show the bulk of new Clark County residents come from the Oregon side, with households earning $100–$200K forming the largest migration cohort (oregoneconomicanalysis.com).

Despite this demand, supply is tight. City planner Chad Eiken notes 12,000+ multifamily units are already under construction or permitted in Vancouver (www.theurbanist.org), yet the city needs about 2,500 new homes per year to keep up (it’s only adding ~1,600–2,000 per year now) (www.theurbanist.org). A comparison (below) highlights the affordability gap: Vancouver’s median price is modest next to Seattle’s or county-wide levels, underscoring why more people keep moving in (www.redfin.com) (www.redfin.com) (www.redfin.com).

Against that backdrop, certain areas stand out as future hotbeds of housing. Downtown/Waterfront is already transforming. The 32-acre Waterfront Vancouver project (redeveloping the old paper mill site) has only 4 of 22 blocks remaining undeveloped as of late 2023 (www.theurbanist.org). Its first phase – waterfront park, Grant Street Pier and mixed-use buildings – opened in 2018, and multiple condo and office towers carried on into 2024. The city has even designated the downtown core (including Esther Short Park and the south waterfront) an Opportunity Zone (www.cityofvancouver.us). City planning boss Chad Eiken emphasizes that “multifamily residential is really the headline of the city’s growth,” noting “we have over 12,000 multifamily units…either under construction or in our development pipeline.” (www.theurbanist.org) In short, downtown is bursting with condos and apartments in the pipeline. Developers echo this urgency: Gramor’s Barry Cain (Waterfront Vancouver’s lead developer) says the aim was to demonstrate downtown had “changed direction,” finally shedding its old “Van-tucky” image (www.theurbanist.org).

North of downtown, Fourth Plain Boulevard (the old central commercial strip) is gearing up next. Vancouver’s new “Fourth Plain for All” investment plan allocates over $25 million (ARPA funds) into infrastructure and housing along 4th Plain between I-5 and I-205 (www.cityofvancouver.us). Key among these is $9.5M to support new affordable housing in that corridor (www.cityofvancouver.us). The area – spanning points from Vancouver Mall east to Bagley Park – has existing subarea plans (e.g. the 4th Plain Forward plan) and an Opportunity Zone (www.cityofvancouver.us). Public officials see it as a rebounding “International District” with future housing and jobs. In practice, this means projects in Rose Village, Walnut Grove and nearby neighborhoods are prime for redevelopment (especially near new bus or bike investments).

Meanwhile, the Heights District (Vancouver’s former Tower Mall area) is moving from plan to reality. This city-led redevelopment will remake two big super-blocks in Central Vancouver. The City is paying to build new streets, parks and a multi-modal “Grand Loop” pathway. Roadwork starts in 2026: a redesigned Mill Plain/MacArthur intersection (early 2026) and the looping pedestrian park (early 2027) (www.cityofvancouver.us). On top of that infrastructure, developers are lined up: Sites C and P (at Mill Plain & Devine) will deliver 184 affordable rental units plus a community market hall, with construction slated 2027–29 (www.cityofvancouver.us). Another builder (Pahlisch) will convert an old driving range into townhomes on Sites M and O (starting ~2028) (www.cityofvancouver.us). The Heights program was approved by City Council in late 2025 (www.cityofvancouver.us), and it’s designed as a walkable, mixed-income neighborhood. As one city planner explains, this “20-minute neighborhood” will connect to parks, light rail and schools. In short, Heights is poised for hundreds of new homes once roads and utilities are in.

Beyond these cores, change is more gradual. The I-5 corridor north of downtown (Hazel Dell, Salmon Creek) and east suburbs have pockets of infill but no blockbuster projects announced. However, new statewide and county policies will spur growth there. In early 2024, Clark County adopted its ‘Housing Options’ code changes (clark.wa.gov) – essentially legalizing duplexes, triplexes and accessory units across most residential areas. This means many single-family streets in Vancouver and Hazel Dell can now be redeveloped at higher density. In short, “missing middle” housing is now permitted citywide, so smaller builders can add townhomes where they couldn’t before. For example, any neighborhood in Vancouver can now be eligible for up to triplexes by-right (clark.wa.gov). That policy isn’t tied to one neighborhood but means investors should watch the suburbs (Orchards, Salmon Creek, etc.) for wave of renovation.

Evidence from interviews tracks this. A Vancouver planner (Chad Eiken) notes that multi-family construction is the city’s headline – and indeed over 12,000 units are queued (www.theurbanist.org). A waterfront developer (Barry Cain) recalls that Vancouver needed a “big difference” downtown to signal change (www.theurbanist.org), and his project’s success is attracting national attention. Other local developers spot opportunity in these city-led areas: the heights near Mill Plain, the Fourth Plain corridor, and of course anything along the new BRT line (The Vine).

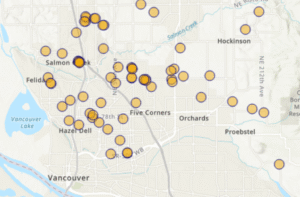

For homebuyers and investors reading ahead, the takeaway is clear: Downtown/Vancouver Landing, Fourth Plain, and the Tower Mall/Heights area are the top 2025+ hotspots. These neighborhoods have big publicly funded infrastructure – transit lines, parks, streets – and official plans allowing dense mixed-use projects. Grid-style neighborhoods further out will gradually follow thanks to county rezoning, but projects there will tend to be smaller infill rather than massive towers. We couldn’t map every permit (few open-data maps break out Vancouver by neighborhood), so readers should watch the City’s building-permit site or news releases for block-by-block details. In a nutshell: Core Vancouver (planned for growth) vs. fringe Vancouver (slower development). Being early on developments in Uptown, Waterfront, and the rapidly changing Fourth Plain zone should give buyers and investors an edge – the project pipeline and policy changes make those pockets the next big wave in Vancouver’s housing market (www.theurbanist.org) (www.cityofvancouver.us).

Sources & Metadata: U.S. Census/ACS (population growth) (www.theurbanist.org); Vancouver City official plan and zoning updates (www.cityofvancouver.us) (clark.wa.gov); City of Vancouver Department of Planning (Opportunity Zones, Heights District, Fourth Plain ARPA) (www.cityofvancouver.us) (www.cityofvancouver.us) (www.cityofvancouver.us); city planning interviews (Chad Eiken, Barry Cain) (www.theurbanist.org) (www.theurbanist.org); Redfin Zillow data for median prices (Oct 2025) (www.redfin.com) (www.redfin.com) (www.redfin.com); Oregon Office of Economic Analysis migration study (oregoneconomicanalysis.com). Each figure is from these cited sources or local planning documents.

About the Author

The Holloway Team is comprised of seasoned professionals dedicated to delivering unparalleled real estate experiences. Lauren, a top-producing agent at Compass, brings a wealth of expertise to ensure a smooth and stress-free experience, making your journey as effortless as possible. Henry, as our Data Analytics expert, provides actionable insights to drive informed decision-making in the real estate team. As a team we stand out as the preferred choice for clients seeking a seamless real estate experience in Southwest Washington.